FEATURED

🌡️ Renters vs. Heat, Hype & Headwinds: What L.A. Tenants Need to Know This Week

Welcome to The Tenure View, If you rent in L.A., you’re living through a weird split-screen: 📈 more homes finally hitting the market and prices wobbling… while 📉 homeownership keeps sliding and low-income renters get squeezed hardest. Add in a proposed 82°F indoor temp rule, a County delay on rent relief for immigrant families, and even 🏅Olympics-era luxury rentals already surging—and it’s a lot.

Here’s the signal, not the noise—plus a Tip of the Week on applications & credit checks you can use today.

⚠️ The Big Picture: Cooling Market, Stubborn Pressures

Inventory is up. Listings across L.A. County jumped ~30% year-over-year this summer. More supply usually means more negotiating power for buyers and—eventually—less pressure on rents. But the full reset isn’t here yet. 🕰️

Sales are still sluggish. 2024 barely ticked above 2023, and 2025 is tracking flat. Analysts expect a fuller market reset around 2027–2028—when cheaper prices + speculators + a new wave of first-time buyers converge. Until then, think “slow grind,” not “sudden relief.” 🐢

Mortgage rates remain the villain. With borrowing costs roughly 2x their 2013 levels, prices feel heavy. Even modest rate dips haven’t flipped buyer psychology.

Homeownership keeps falling. L.A. County’s rate hovers in the mid-40s%—near a half-century low—thanks to high prices, scarce starter homes, and Prop 13’s lock-in effect keeping owners put. USC researchers say the ownership path has narrowed most for middle-income households ($50k–$150k) and Black households in L.A. specifically. 📉

We built mostly rentals—but too few affordable ones. About 83% of the last seven years’ completions were rentals, yet only ~10% are affordable to low-income households. Result: 90% of renters earning <$50k spend more than 30% of income on rent; 70% spend more than half. That’s not sustainable—and it shows up in your monthly stress. 💸

Construction is lopsided. Single-family starts nudged up last year; multi-family starts slumped after pandemic-era peaks. Financing costs, supply chains, and permitting frictions are still real. The mix needs to swing back toward multi-family to dent rent burdens.

Jobs picture: meh. Employment crawled up just +0.2% year-over-year and remains ~84k below the pre-pandemic peak. Without stronger wages and job growth, households can’t catch up to housing costs. ⚙️

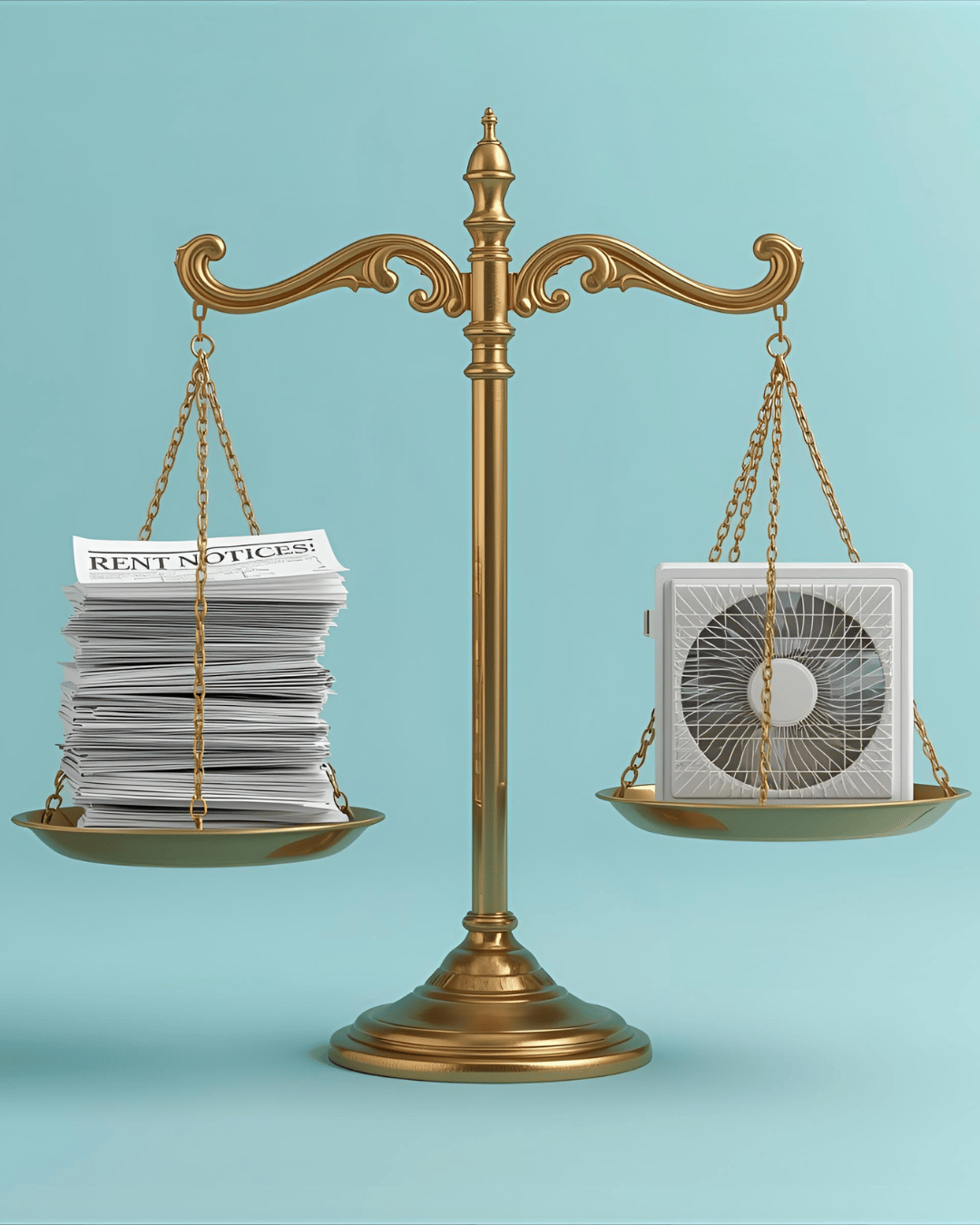

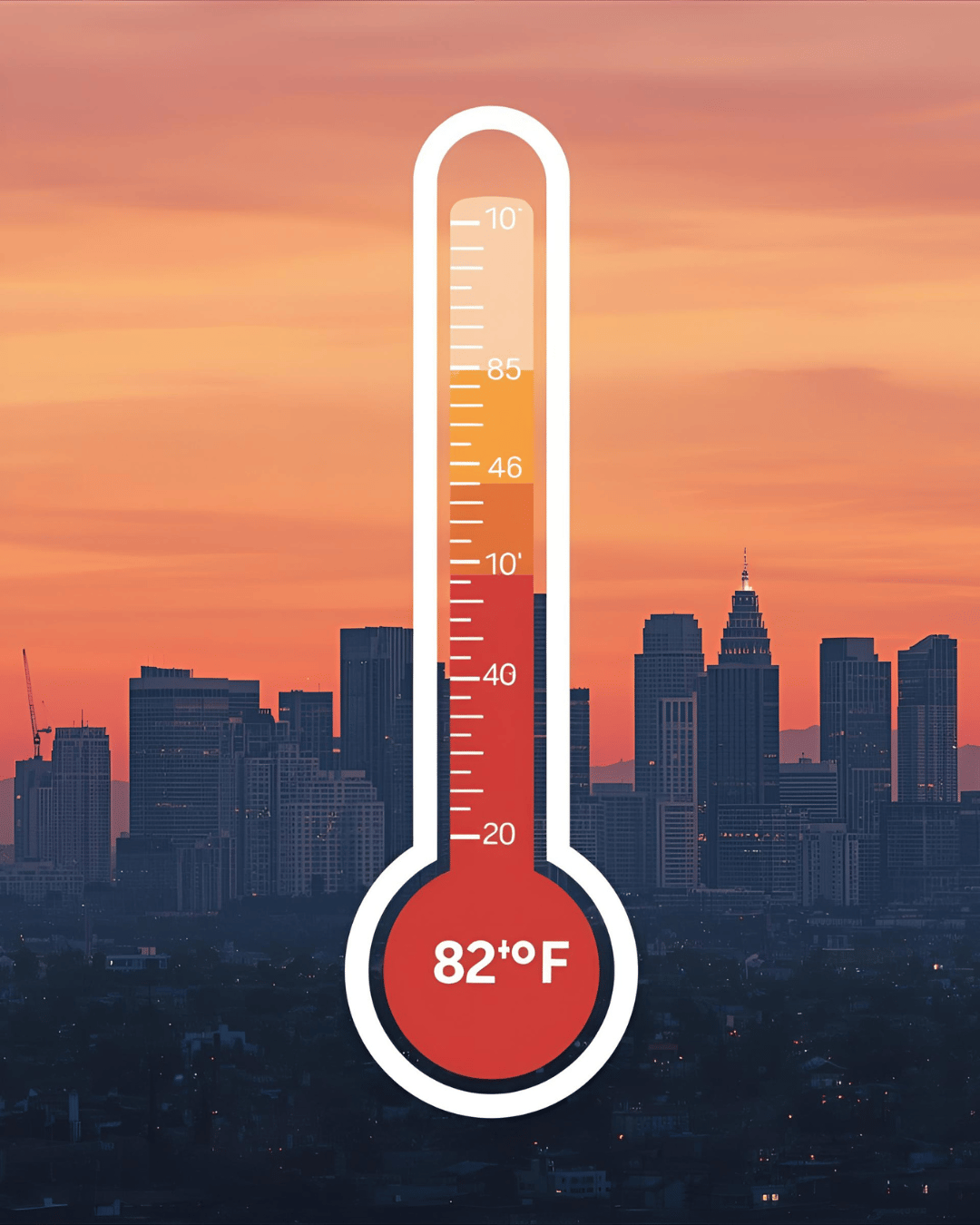

🧊 Heat Safety: City Moves Toward an 82°F Indoor Limit

Following the County’s action, L.A. City Councilmembers introduced a motion to cap indoor temps at 82°F in rentals. That would require landlords to provide remedies (AC, fans, passive cooling, etc.) and protect tenants who install allowed portable devices. Supporters frame it as basic habitability in an era of 110°+ heat waves; landlord groups warn about costs and electrical upgrades.

What it means for renters right now:

Expect a debate over enforcement timelines, room-by-room standards, and help for small owners.

If the City follows the County’s lead, complaint-based enforcement and education-first approaches are likely.

If you’re in unincorporated L.A. County, the County’s 82°F rule is already on the books with phased compliance and protections to install cooling without retaliation.

Save receipts, document temps, and photograph cooling barriers—paper trails matter. 📷📝

🧩 Policy Moves to Watch

Simplified Housing Notices 🧾: A City motion would create plain-language, legally compliant templates for rent control, just-cause, and right-to-counsel notices; add help desks for small owners; and study a deferred-maintenance fund. Clarity helps everyone—and cuts down “weaponized paperwork.”

Rent Relief for Immigrant Families ⏸️: A County motion to expand emergency rent relief (including households losing income due to recent ICE actions) was delayed for further review. Advocates are pushing hard; we’ll watch the next Board agenda.

Olympics Luxury Rental Surge 🏅: Three years out, ultra-luxury mansions are already booking for LA28 at eye-watering rates. It’s a niche market—but it speaks to a broader theme: short-term demand spikes complicate an already tight rental ecosystem.

📊 Where This Leaves L.A. Renters (Plainly)

Short term (now–2026): More listings, uneven prices, tough affordability. Good chance for selective deal-finding, especially with concessions (free weeks, fee waivers).

Medium term (2027–2028): Likely bottoming-in-progress → better tenant leverage as supply and pricing stabilize.

What to do now: Know your caps, check your renewal math, negotiate! If your building is slow to lease, ask for a concession—they’re on the rise again in many markets.

🧰 Tip of the Week: Applications & Credit Checks (Save it. Share it.) 💡

If a landlord denies you (or asks for a higher deposit) due to your credit report, you have rights.

Get the reason—in writing.

If your application is denied or you’re required to pay more based on your credit report, you’re entitled to an adverse action notice naming the screening company used and explaining your right to a free copy and to dispute errors.Pull the exact report they saw (free).

Use the screening company info in that notice to request a free copy within 60 days. Review for: wrong balances, mixed files (common if you share a name), paid collections still showing as open, or outdated negatives.Dispute fast, in writing.

Send disputes to both the screening company and the credit bureau, include proof (letters, receipts, court docs). Ask for expedited reinvestigation and a corrected report back to the landlord. Keep everything in a folder—timestamps win.Add a short consumer statement (optional).

If time is tight (you need housing now), a 100-word note can flag context (e.g., medical debt in dispute, identity theft case #). Not a silver bullet, but it helps.Pre-screen yourself next time.

Before you apply, check your own credit, gather income proof, and prepare a “Context & Stability” one-pager: current employer, length of employment, on-time payment screenshots (utilities, phone), prior landlord reference, and savings balance. This reframes the conversation from “score” to “stability.”

Copy-paste DM template to request the screening info (polite + firm):

Hi [Manager Name], thanks for reviewing my application. I understand a decision was made based on credit information. Please send the adverse action notice and the name/contact of the screening company so I can request my free copy and correct any errors. Thank you!

🌟 Community Spotlight: Housing Rights Center (HRC) (@HRCLosAngeles) 🤝

If you’re dealing with a rent hike you don’t recognize, confusing notices, or possible discrimination, Housing Rights Center is a powerhouse resource for L.A. renters.

What they do: Free tenant counseling hotline, RSO/just-cause guidance, habitability & harassment help, and fair housing investigations (disability, family status, language, race, source-of-income discrimination, etc.). They also run regular Know Your Rights workshops in multiple languages.

Why we’re spotlighting them now: With heat standards evolving and paperwork getting “simplified,” having a neutral counselor read your notice can prevent costly mistakes—and HRC can spot discrimination or illegal fees fast.

Use it today:

Call the hotline and ask, “Can you review this notice/rent increase?”

If you suspect discrimination (e.g., a voucher or accent is treated differently), ask for an intake to start a fair housing investigation.

Bring your lease + any notices + a temp log/photos if it’s a heat/habitability issue.

We’re not paid to boost HRC—we’re highlighting them because their counselors consistently help renters turn scary paperwork into a clear plan.

💬 Quick Wins for This Week

Heat plan: If your unit regularly exceeds 82°F, start a temperature log (date/time/room + photos of a thermometer). Ask in writing for remedies (fans/AC/passive fixes).

Renewal math: If you’re up for renewal, ask: “Are there concessions available?” (weeks free, waived parking/pet fees, free AC unit).

Application prep: Create your Context & Stability one-pager before your next viewing. It’s your renter résumé.

Share this: Forward this edition to 3 friends who rent in L.A.—help them protect their housing, and help us stay free.

🙌 Help Us Keep This Free (and Better)

Our work stays free because this community shares, supports, and (soon) partners. If your org serves L.A. renters (legal aid, insurance, moving/storage, financial coaching, workers’ rights, climate resilience), reply to this email—we’re building an “Anchor Sponsor” who underwrites tools like our Renters Essentials Toolkit.

Reading helps. Sharing protects.

If this helped you today, send it to a neighbor, coworker, or group chat. 💛

—The Tenure View

P.S. Got denied for “credit reasons”? Hit reply with “CREDIT CHECK HELP” and I’ll send you a fill-in-the-blank dispute kit and a clean application checklist.

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.